As the new year begins, tax season looms on the horizon. For accountants, CPAs, and businesses, preparing for tax season 2025 is not just about meeting deadlines—it’s about ensuring accuracy, maximizing efficiency, and avoiding penalties. In this tax season guide, we’ll explore the benefits of preparation, key dates to remember, a comprehensive document checklist, and how cloud hosting can revolutionize your tax season workflow.

Why Preparing for Tax Season 2025 is Crucial?

Proper preparation for tax season is critical for several reasons:

- Avoid Penalties: Missing deadlines or filing incorrect returns can result in hefty fines.

- Maximize Deductions: Early preparation allows you to identify potential deductions and credits.

- Reduce Stress: With proper planning, you can avoid last-minute scrambling and errors.

- Boost Client Satisfaction: For accountants and CPAs, timely and accurate tax filing enhances trust and loyalty.

The Advantages of Early Tax Season Preparation

- Time Management: More time to review documents and ensure compliance.

- Cost Savings: Avoiding late fees and penalties.

- Improved Accuracy: Reduced risk of errors in calculations or missing forms.

- Better Resource Allocation: Focus on high-value tasks rather than last-minute fixes.

Consequences of Poor Tax Season Preparation

- Missed Deadlines: Leading to penalties and interest.

- Audit Risks: Errors or omissions can trigger IRS audits.

- Client Dissatisfaction: Damaged reputation due to delays or mistakes.

- Operational Bottlenecks: Strain on resources and team morale.

Key Tax Season 2025 Deadlines You Can’t Afford to Miss!

Here are the key dates you should mark on your calendar as tax season guide:

- January 16, 2025: Deadline for Q4 2024 estimated tax payments.

- January 31, 2025: Employers must send W-2 forms to employees and file Form 1099-NEC for independent contractors.

- February 15, 2025: Deadline to file Form W-4 for exemptions.

- March 15, 2025: Deadline for S-corporations and partnerships to file Form 1120S and Form 1065, respectively.

- April 15, 2025: Deadline for individual tax returns (Form 1040) and C-corporations (Form 1120).

- April 15, 2025: Deadline for IRA contributions for the 2024 tax year.

Your Essential Document Checklist for Tax Season 2025-

To ensure a smooth tax filing process, prepare the following documents:

For Individuals:

- Social Security numbers for yourself and dependents.

- W-2 forms from employers.

- 1099 forms for freelance or investment income.

- Receipts for deductible expenses (e.g., medical, education, and charity).

- Mortgage interest statements.

- Proof of health insurance coverage (Form 1095).

For Businesses:

- Employer Identification Number (EIN).

- Income statements and balance sheets.

- Payroll records.

- Business expense receipts.

- Forms 1099-MISC and 1099-NEC for contractors.

- Tax returns from the previous year.

Step-by-Step Guide to Tax Season Success

- Organize Financial Records: Ensure all receipts, invoices, and statements are categorized.

- Stay Updated on Tax Code Changes: Be aware of new tax laws for 2025.

- Reconcile Accounts: Verify that bank statements match your financial records.

- Leverage Tax Software Hosting on Cloud: Streamline collaboration and ensure data security.

- Double-Check Deadlines: Plan ahead to avoid missing any critical dates.

Overcoming Common Tax Season Challenges:

- Time Crunch: Manage high workloads with early planning.

- Data Security Risks: Protect sensitive data with robust security measures.

- Collaboration Issues: Streamline team communication using cloud solutions.

- Technical Glitches: Avoid IT disruptions with reliable cloud-hosted tax software.

The Game-Changer: Tax Software Hosting on Cloud:

Tax Software Hosting on Cloud offers a transformative solution for tax professionals. Here’s how:

- 24/7 Accessibility: Work from anywhere, anytime.

- Enhanced Security: Multi-layered protection ensures client data is safe.

- Real-Time Collaboration: Teams can work simultaneously on tax files and much better optimization.

- Automatic Updates: Always use the latest software version.

- Scalability: Easily add users or resources during peak season.

Avoidable Pitfalls with Cloud Hosting

- Data Loss: Cloud backups ensure no critical information is lost.

- Downtime: Reliable servers minimize interruptions.

- Manual Errors: Automated processes reduce mistakes.

- Limited Access: Remote work becomes seamless.

Accounting Firms Switching to Tax Cloud Hosting-

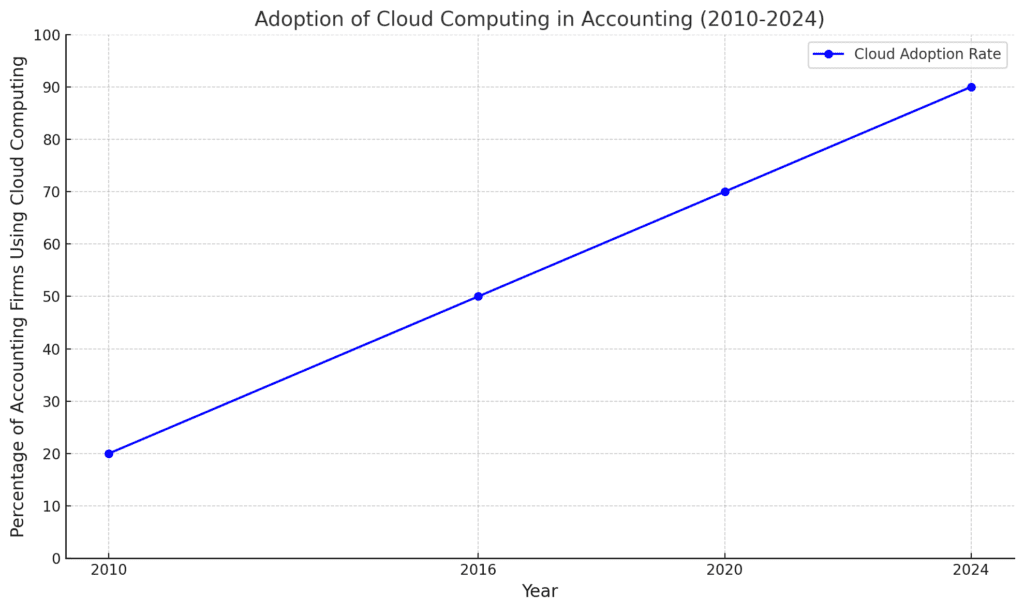

The line graph would depict a steady upward trajectory from 2010 to 2024, illustrating the increasing percentage of accounting firms adopting quickbooks cloud hosting solutions. This visual representation underscores the growing ease and efficiency experienced by accountants as they transition to cloud-based systems.

Mistakes to Avoid This Tax Season:

- Procrastination: Start early to avoid last-minute errors.

- Ignoring Deadlines: Use a calendar to track important dates.

- Overlooking Deductions: Stay informed about eligible deductions.

- Inadequate Security: Use secure systems to prevent data breaches.

- Manual Data Entry: Automate wherever possible to minimize errors.

Pro Tips for Accountants This Tax Season:

- Leverage Automation Tools: Use AI-powered tax solutions to speed up calculations and data entry.

- Focus on Cybersecurity: Enable multi-factor authentication and encryption for client data.

- Review Previous Returns: Identify patterns or recurring issues to improve accuracy.

- Track Tax Law Changes: Stay informed about federal and state-level changes.

- Use Cloud Hosting Wisely: Ensure your cloud hosting provider offers 24/7 support and guaranteed uptime for tax season.

- Backup Regularly: Maintain multiple backups to safeguard against data loss.

- Educate Clients: Share updates and tips with clients to reduce errors and delays.

FAQs

1. What is Tax Software Hosting on Cloud? Tax software hosting on the cloud allows you to access your tax applications and data from any device with internet connectivity. It enhances security, collaboration, and efficiency.

2. How Can OneUp Networks Help During Tax Season? OneUp Networks specializes in hosting tax and accounting software on secure cloud servers. We offer real-time collaboration, data backups, and 24/7 support to streamline your tax season cloud hosting.

3. Is My Data Secure on the Cloud? Yes, with multi-layered security protocols, encryption, and regular audits, cloud hosting ensures your data remains protected.

4. What is the Cost of Cloud Hosting? Our plans are flexible and tailored to your needs. Contact us for a free trial or demo.

Tax season 2025 doesn’t have to be a daunting experience. With the tax season guide, right preparation, tools, and strategies, accountants can streamline their workflow and avoid unnecessary stress. Cloud hosting of tax software is a game-changer, offering unparalleled accessibility, security, and collaboration benefits. By leveraging services like those offered by OneUp Networks, you can ensure your processes are efficient, secure, and reliable during this critical time of the year.