CCH ProSystem fx Tax is a leading tax preparation and compliance software designed to streamline the workflow of accounting firms and tax professionals. As the cornerstone of the CCH ProSystem fx Suite, it offers robust integration with other tools such as CCH Engagement, Fixed Assets, and Practice Management programs. This comprehensive suite is tailored to meet the needs of firms of all sizes by automating tax preparation processes, enhancing collaboration, and ensuring compliance with federal and state regulations. CCH ProSystem fx on Cloud gives a lot more advantage than using simply on desktops at office premise.

Key Features of CCH ProSystem fx Tax

- End-to-End Digital Tax Workflow: The software facilitates a seamless digital tax workflow, enabling real-time collaboration with clients and providing instant access to regulatory guidance.

- Thousands of Automatic Calculations: It supports thousands of forms and schedules for federal, state, county, and city entities, significantly reducing manual input errors.

- Integration Capabilities: CCH ProSystem fx Tax integrates with other modules like Autoflow for document automation, Fixed Asset software for depreciation tracking, and View Scan software for document management.

- Scalability: Whether you’re a small firm or a large enterprise, the software adapts to your needs, offering scalable solutions.

Pain Points in Traditional Tax Software Usage

Tax professionals often face challenges such as:

- Time-Consuming Data Collection: Gathering client documents through emails can be inefficient and prone to delays.

- Manual Errors: Using outdated systems increases the risk of calculation errors and compliance issues.

- High Costs: Maintaining legacy systems incurs recurring expenses related to hardware upgrades and IT support.

These inefficiencies can lead to missed opportunities for profit and reduced client satisfaction during the busy tax season.

Why Host CCH ProSystem fx Tax Software on the Cloud?

Cloud hosting offers transformative benefits for tax professionals using Wolters Kluwer CCH ProSystem fx Tax software. Here’s how:

1. Enhanced Collaboration

Hosting CCH ProSystem fx on the cloud allows teams to work collectively in real-time. Clients can directly upload documents into the tax software, eliminating back-and-forth communication via email. This streamlined process saves time and enhances accuracy.

2. Scalability

The cloud provides a scalable environment where you can integrate add-ons like Autoflow or Fixed Asset software without worrying about resource limitations. Whether your firm grows or downsizes, cloud hosting adjusts accordingly without requiring hardware replacements.

3. Cost Efficiency

Switching from in-house legacy systems to cloud hosting eliminates costs associated with hardware maintenance, upgrades, and dedicated IT staff. Firms only pay for the resources they use, optimizing their budget.

4. Security

Tax data is highly sensitive, making security paramount. Cloud hosting providers deploy safeguards like multi-factor authentication, data encryption, enterprise-grade firewalls, and intrusion detection systems to ensure confidentiality.

5. Business Continuity

With guaranteed uptime of 99.99%, cloud hosting ensures uninterrupted access to tax applications even during disruptive events. Automated backups provide rollback capabilities for up to 45 days.

Real-Life Example: Transforming a Mid-Sized Accounting Firm

A mid-sized accounting firm transitioned from legacy systems to hosting CCH ProSystem fx Tax on our cloud platform. The results included:

- A 40% reduction in operational costs.

- Improved client satisfaction due to faster document processing.

- Enhanced compliance with automated updates to regulatory changes.

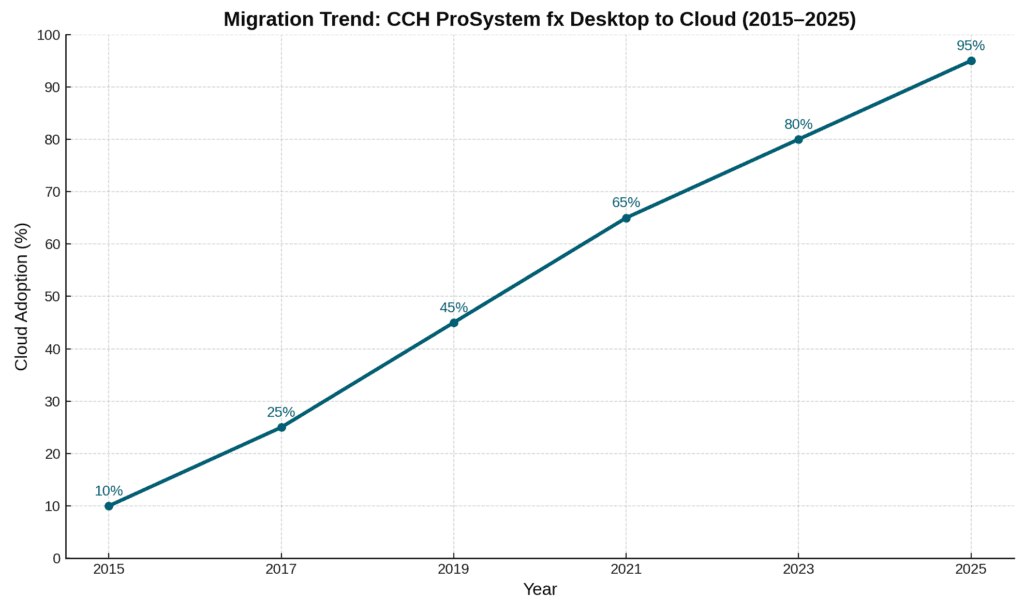

84% of large firms, 67% of mid-size, and 46% of small firms were using or planning to use cloud solutions within three years. [Source: Wolters Kluwer Press Release]

How OneUp Networks Differentiates Itself!

At OneUp Networks, we specialize in hosting accounting software like CCH ProSystem fx Tax on secure and high-performance cloud platforms tailored for U.S.-based accounting firms.

Empathy for Common Challenges

We understand the frustrations tax professionals face during peak seasons—delayed client responses, manual workflows eating into profits, and compliance risks due to outdated systems. Our solutions address these pain points head-on.

Our Unique Offerings

- Customized Solutions: We tailor cloud environments based on your firm’s size and needs.

- Always-On Support: Our dedicated team provides round-the-clock assistance via phone, chat, or email.

- High-Performance Servers: Powered by SSD storage for seamless operations during high-demand periods.

- Free Trial: Experience our services risk-free with a 7-day trial.

Ready to revolutionize your tax practice?

Contact OneUp Networks today to learn more about hosting CCH ProSystem fx Tax software on our secure cloud platform. Let us help you maximize productivity while minimizing costs!

Conclusion

CCH ProSystem fx Tax software is already an industry leader in tax preparation and compliance solutions. Hosting it on the cloud takes its capabilities further by addressing common pain points such as inefficiency, security concerns, and high costs.

OneUp Networks empowers tax professionals by providing secure, scalable, and cost-effective cloud hosting solutions that ensure your firm stays ahead in an increasingly competitive market.