In today’s fast-paced world, the tax and accounting industry is witnessing a remarkable shift by switching to cloud hosting. This transformation is driven by the need for efficiency, security, and flexibility—qualities that are becoming non-negotiable for tax professionals. As the digital landscape evolves, cloud hosting has emerged as a game-changer, providing solutions that align with the demands of modern tax practices.

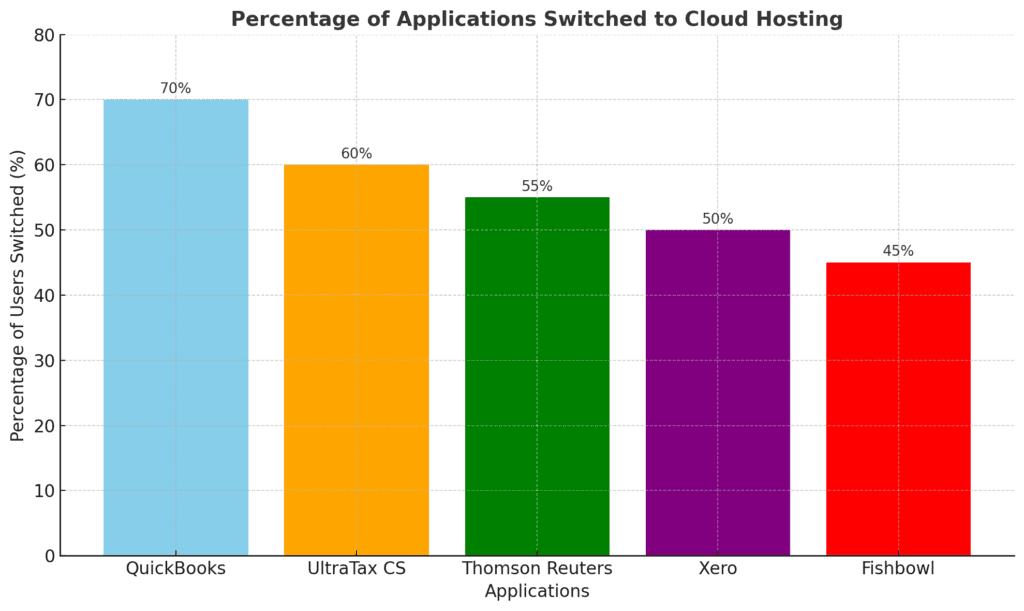

Here is a bar graph showing the percentage of users for various applications like QuickBooks, UltraTax CS, Thomson Reuters, Xero and Fishbowl that have switched to cloud hosting. It highlights which applications are leading in this transition.

1. Enhanced Data Security

Tax professionals handle highly sensitive client information, including Social Security numbers, financial statements, and tax returns. The security of this data is paramount, and hosting in the cloud offers robust solutions to safeguard it.

How Cloud Hosting Ensures Security:

- Data Encryption: Cloud servers encrypt data both in transit and at rest, making it nearly impossible for unauthorized individuals to access.

- Multi-Factor Authentication (MFA): This adds an extra layer of security by requiring multiple forms of verification.

- Regular Backups: Automatic backups ensure that data is not lost due to accidental deletion or cyberattacks.

- Compliance Standards: Leading cloud providers comply with industry regulations like SOC 2, GDPR, and HIPAA, giving tax professionals peace of mind.

Example:

A mid-sized CPA firm transitioned to cloud hosting after experiencing a ransomware attack that compromised client data. Post-transition, the firm reported zero security breaches and improved client trust.

Fact: According to a 2023 report by Gartner, 95% of cloud security failures are due to user error, not cloud provider vulnerabilities. With proper training and protocols, cloud hosting can significantly reduce risks.

2. Accessibility and Flexibility

The traditional 9-to-5 work model is becoming obsolete, especially for tax professionals who often work beyond standard hours during tax season. Cloud hosting enables them to access files and applications anytime, anywhere.

Key Features:

- Device Independence: Access your data from desktops, laptops, tablets, or smartphones.

- Remote Collaboration: Teams can work together in real-time, even if they are geographically dispersed.

- Scalability: Easily adjust server resources based on workload demands.

Example:

During the COVID-19 pandemic, a tax consultancy firm leveraged cloud hosting to enable remote work for its 50 employees. This not only ensured business continuity but also increased productivity by 30%.

Fact: A study by FlexJobs found that 77% of remote workers report higher productivity, thanks to flexible working conditions provided by cloud hosting.

3. Cost-Effectiveness

Cloud hosting eliminates the need for expensive on-premises servers, maintenance, and IT staff, making it a cost-effective solution for tax professionals.

Cost-Saving Features:

- Pay-as-You-Go Model: Pay only for the resources you use.

- Reduced Downtime: Reliable cloud infrastructure minimizes costly downtimes.

- Energy Efficiency: Cloud data centers are more energy-efficient than traditional setups.

Example:

A small tax & accounting industry saved over $10,000 annually by switching from on-premises servers to quickbooks cloud hosting. The savings were reinvested into employee training and client acquisition.

Fact: According to a report by Deloitte, businesses can save up to 30% on IT costs by migrating to the cloud.

4. Automation and Integration

Tax professionals rely on various software applications to streamline their work. Cloud hosting supports seamless integration and automation, enhancing efficiency.

Benefits:

- Software Updates: Automatic updates ensure you’re always using the latest version.

- Integration with Tax Applications: Cloud hosting supports popular tools like QuickBooks, UltraTax CS, and Thomson Reuters.

- Workflow Automation: Automate repetitive tasks like data entry and reporting.

Example:

An independent tax consultant integrated QuickBooks and UltraTax CS on a cloud-hosted server. This integration reduced manual data entry errors by 80% and saved 10 hours per week.

Fact: A report by Accenture highlights that automation can improve tax compliance efficiency by up to 40%.

5. Disaster Recovery and Business Continuity

Natural disasters, cyberattacks, or hardware failures can disrupt operations. Hosting in the cloud ensures business continuity through robust disaster recovery solutions.

Features:

- Redundant Servers: Data is stored in multiple locations to prevent loss.

- Quick Recovery: Recover data and applications within minutes.

- Minimal Downtime: Ensure uninterrupted service during emergencies.

Example:

A tax firm in Florida experienced a hurricane that damaged its office. Thanks to cloud hosting, the firm resumed operations within 24 hours without losing any client data.

Fact: The Uptime Institute reports that cloud-hosted businesses experience 40% less downtime compared to those relying on on-premises servers.

Frequently Asked Questions (FAQ)

Q1: Is hosting on cloud suitable for small tax and accounting industry?

A: Absolutely. Switching to Cloud Hosting is scalable, making it ideal for firms of all sizes. Small firms can start with basic plans and scale up as needed.

Q2: How secure is cloud hosting for sensitive tax data?

A: Cloud hosting providers use advanced security measures like encryption, MFA, and regular audits to ensure data safety.

Q3: Can I integrate my existing tax software with cloud hosting?

A: Yes, most cloud hosting platforms support integration with popular tax software like QuickBooks, UltraTax CS, and more.

Q4: What happens if there’s a server outage?

A: QuickBooks Enterprise hosting providers have redundant servers and failover mechanisms to minimize downtime and ensure business continuity.

Q5: How can OneUp Networks help during tax season?

A: OneUp Networks specializes in hosting tax and accounting applications. We offer:

- Customized Plans: Tailored to your specific needs.

- 24/7 Support: Expert assistance whenever you need it.

- Advanced Security: Protecting your data with top-tier measures.

- Scalability: Easily adjust resources during peak tax season.

Conclusion

The shift to hosting is more than a trend—it’s a necessity for tax and accounting industry aiming to stay competitive and efficient. Enhanced security, accessibility, cost-effectiveness, automation, and disaster recovery are compelling reasons to make the switch. As the tax season approaches, partnering with a reliable provider like OneUp Networks can make all the difference. With over a decade of experience in cloud hosting, we are committed to empowering tax professionals in Tax Season 2025 with solutions that drive success. Contact us today to explore how we can transform your tax practice.